About me

What makes me qualified to assist you on this financial journey? I’m glad you asked! My own journey goes back to my childhood. I believe each family has spenders and savers. I was definitely the saver of my siblings. I can remember saving up for my first major purchase: a Sega Genesis gaming console. Talk about a rewarding experience! I’ve been trying to stretch dollars for as long as I can remember.

As far as my financial career, that actually didn’t officially launch until I was 29 years old. I had worked in various sales jobs through the years and ended up working for a funeral home corporation selling pre-need funeral arrangements(I know, I know…). While working there, I had to obtain a life insurance license due to the way the pre-arrangements were funded. This happened in 2009.

As a result of this, my name and license become public knowledge to every life insurance headhunter out there. I got a call from one of the top companies in the business and went to work for them in 2010. This is where I learned I needed to be in finance. I learned the ins and outs of life insurance, annuities, investments, long term care, and various other types of similar products. I had a great mentor/trainer during that time who took me under his wing and showed me the ropes. The information was so valuable to me in my own planning that I knew I needed to spread the word. Indeed, I probably wouldn’t have any life insurance today outside of my job if it wasn’t for that time as an agent. I went on to earn my Series 7 and 63 licenses while employed for that company.

Unfortunately, that job was 100% commission, which meant that some months I worked long hours and didn’t get paid a dime. I was the sole income at home and starting to have children, and that inconsistency wasn’t going to cut it. I transitioned into banking in 2013 as a branch manager for a well-known regional bank in the southeast. There, I received valuable training on how to be a banker: how banking works, all you want to know about credit and loan underwriting, interest rates, etc.

I stayed in banking until 2019. I left that year to become a financial consultant at a national investment firm where I earned my Series 66 license. I loved that job, but the office was closed 6 months after I started due to an impending merger and I didn’t want to change cities. I then became a financial advisor with another firm and, 6 months later, COVID-19 took over and my job ended. So, after two stints of bad luck, I landed another branch manager gig in April of 2020 and have been there ever since.

I learned through the ups and downs that banking is where I needed to be. I also learned, through various opportunities along the way, that I love educating people on their personal finances. Most people have no clue, and they have no clue that they have no clue. Nothing made me happier at work than to have someone inform me they took my advice, applied it, and their situation changed for the better because of it.

I noticed throughout the years that I often had customers ask me the same questions. This taught me what types of questions most people have about finances. Answering those questions became the launch of my vlog and now my blog. I know if one video or one article can make a difference in someone’s future then it’s all worth it.

My background in insurance, investments, and banking all come together to form the foundation of my answers to these questions. In many cases, a person may ask their insurance agent a financial question and the answer will be all about insurance and will lack any investment input. Or a question gets asked about banking and your banker doesn’t know anything about insurance. My approach takes ALL these areas into consideration. I have experienced a lot, and I love to inspire others to take action.

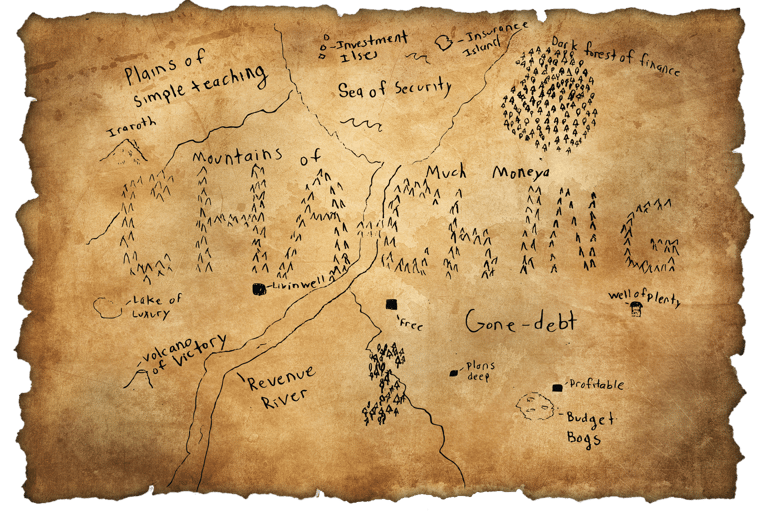

This background, coupled with my fondness for the fantasy classic The Lord of the Rings, formed what became my brand, Fellowship of the Frugal. I often make references to the book on my website or take a movie quote and slightly alter it for amusement. In the book, the hobbits were initially apprehensive about Stryder when they first met him. Later, they came to trust him just as much as they trusted Gandalf as a result of seeing his expertise and skill over the course of many miles. For our journey, if you are apprehensive about “finance people” yet still seeking answers, give me a chance. I am optimistic that you will gain valuable insights into all of these financial topics as you engage with my site.

That's me in a nutshell. Now, let's get started!